Over 80 per cent of home buyers will be better off under LBTT

On Wednesday 1 April, Scotland enters a (brave?) new world with the introduction of Land and Buildings Transaction Tax – LBTT. This is a “Tartan” tax; the result of legislation by the Scottish Parliament introduced by the Deputy First Minister and Cabinet Secretary for Finance, Constitution and Economy for the Scottish Government, John Swinney.

LBTT replaces SDLT in Scotland, but SDLT continues in England and Wales, administered by HMRC, on behalf of the UK Parliament.

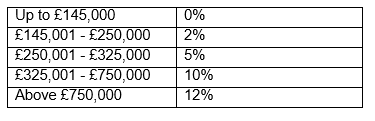

Being a first foray into Scottish tax, by the Scottish Government, the introduction has been attended by a fair amount of comment, some of which has been negative. It might be useful to remind ourselves of the tax bands. They are as follows:

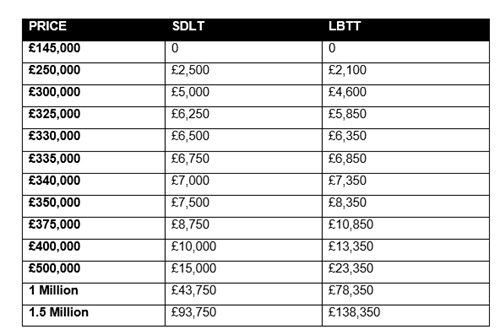

How does this compare to SDLT? The below table shows a sampling of various prices and the consequent tax takes under the different systems.

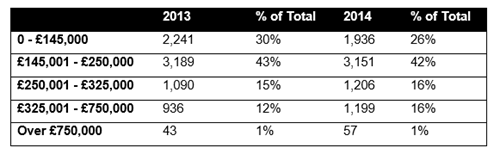

Those figures make interesting reading but to put the matter in context, here is a table showing the proportion of sales matching LBTT thresholds for the last 2 years in our area.

However, it will not just be residential buyers and sellers who will be affected by the change to LBTT.

When Mr Swinney introduced the draft legislation he stated that the intention was to create a “fairer” tax where the majority of purchasers in Scotland would pay less, under LBTT, than under SDLT. From the figures in the table you can see that he will be able to argue that he has achieved that aim. The “Tartan Tax” bears less heavily on those who pay no more than £335,000 for their property and, in our area – one of the areas of Scotland with a relatively high average price – over 80% of purchasers will be better off, to a greater or lesser degree, under LBTT than under SDLT.

What is thought provoking, however, is the extent of the higher tax payable by those who buy higher value property. That makes one ponder in what manner further tax raising powers will be utilised by the Scottish Government.