Only one year left of Help to Buy in Scotland: what you need to know

The Help to Buy scheme, which assists first time buyers and eligible homeowners get onto the property ladder, has only one year left to run in Scotland.

The scheme provides help, up to 15% of the purchase price of an affordable new build home, through participating house builders – and, according to Scottish Government statistics, 160 households in Aberdeen and Aberdeenshire used Help to Buy in April 2016 – March 2017 to support making a purchase.

Overall, the scheme is useful for giving first time buyers a boost, and is something to discuss with your house builder and solicitor.

Here are a few things which you should consider when looking to use the Help to Buy scheme before the 31 March 2019 deadline.

Price limit for using Help to Buy

In an update from original plans, the price cap on properties eligible for Help to Buy is remaining at £200,000 in 2018/19.

The plan had been that the limit would drop to £175,000 for the final year of the scheme, but housing minister Kevin Stewart announced last year that this had been amended, to help “make home ownership as accessible as possible – with a particular focus on helping people to buy affordable new-build homes.”

You cannot use Help to Buy to pay for a house which costs more than £200,000. This makes it perfect for people who are looking for their first home.

Making sure you are eligible for Help to Buy

Only participating house builders are eligible for Help to Buy – and it only applies to new build houses. When you have found a property, and spoken to the house builder, they will be able to put you in touch with a Help to Buy agent - Grampian Housing Association Limited covers Aberdeen and Aberdeenshire.

You must reserve a property and obtain a full Reservation Agreement before applying to the scheme, and will then be contacted by the agent to let you know if your application is eligible.

It is worth remembering that Help to Buy is not available to assist buy-to-let investors, those looking to self-build a property or anyone who currently owns a home. If you do already own a home, this must be sold before you can conclude the Help to Buy transaction.

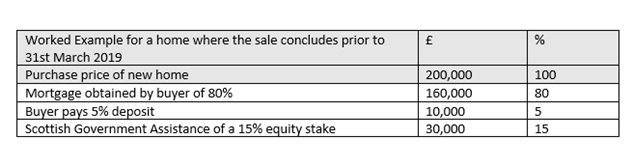

A mortgage for at least 25% of the cost of the house must be taken out through a qualifying lender, and it must by a repayment mortgage (not an interest-only mortgage). It will normally be expected that you will pay a 5% deposit and take out a mortgage for 80% of the property price, with Help to Buy covering the remaining 15%.

An example below from the Scottish Government Help to Buy: Information for buyers leaflet shows how this could work:

If you are 60 or over and wish to apply without a mortgage, or with a mortgage for less than 25% of the purchase price, the guidelines state you must also demonstrate a housing need to move which should include at least one of the following:

- Under occupation – living in property which is too large and need to downsize

- Property no longer suitable to meet needs – can no longer manage stairs, for example

- Support – need to move closer to family or friends that provide care and support

Completion date

You will not be able to complete your application if your proposed date of entry is more than nine months away.

Similarly, missives for the purchase of your home must be concluded on your behalf no later than three months after the date that you are issued with an Authority to Proceed Letter. If missives are not concluded within this period, your application to the scheme will fail.

It is worth remembering that all missives must be concluded by 31st March 2019.

How you pay the money back

When a house, acquired under the auspices of the scheme comes to be sold, sometime in the future, the Scottish Government will require to be repaid 15% of the sale proceeds. It is open to the homeowner to take steps to repay the amount during the course of ownership.

It may be that the Scottish Government will extend the scheme, or create a new scheme to assist people to move onto the property ladder – for example, see Land and Building Transaction Tax scrapped for first time buyers, on properties up to £175,000.